Tax credits for health care would take a hit, now and in the future, under Republicans’ current draft of a plan to replace the Affordable Care Act, or Obamacare. That’s the finding of a new study from the Kaiser Family Foundation.

Tax credits for health care would take a hit, now and in the future, under Republicans’ current draft of a plan to replace the Affordable Care Act, or Obamacare. That’s the finding of a new study from the Kaiser Family Foundation.

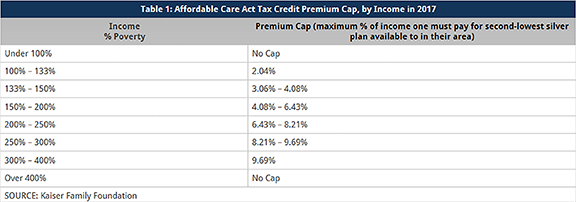

A news release issued this morning from KFF this morning details the study. It says, “The average health insurance premium tax credit received by consumers in 2020 would be at least 36 percent lower under replacement proposals being discussed by Republicans in Congress than under the Affordable Care Act,

“The analysis find the average tax credit also would increase more slowly under replacement proposals.

In the “House Discussion Draft” alternative to the ACA, the average tax credit for current ACA marketplace enrollees would rise from an estimated $2,957 in 2020 to $3,729 in 2027. By comparison, the average tax credit under the ACA would be $4,615 in 2020, increasing to $6,648 in 2027.

“This analysis focuses on alternative ways to provide premium assistance for people purchasing individual market coverage, explaining how they work, providing examples of how they’re calculated, and presenting estimates of how assistance overall would change for current ACA marketplace enrollees. Issues relating to changing Medicaid or methods of subsidizing cost-sharing will be addressed in other analyses,” the KFF said.

Study’s look at health insurance premium tax credits

Read the full Kaiser Family Foundation study at: new analysis from the Kaiser Family Foundation.